Investing can seem like a daunting task, especially for beginners who are just starting out.

With so many investment options available, it can be overwhelming to know where to begin. However, investing is an important aspect of building wealth and securing your financial future.

As a beginner, it’s important to understand the basics of investing.

This includes understanding the different types of investments available, such as stocks, bonds, and mutual funds. It’s also important to understand the risks and potential rewards associated with each type of investment.

When I was starting out, my goal was to employ my money to get a reward every year.

Initially, the task looked complicated, with so much financial news, graphs, and expert comments around, however, in reality, investing can be really simple.

In this article, I will provide an introduction to investing for beginners. I will cover the basics of investing, including the different types of investments available and the risks and rewards associated with each.

By the end of this article, you will have a better understanding of investing and be better equipped to start building your investment portfolio.

Understanding the Basics

As a beginner in investing, it’s important to understand the basics before diving into the world of stocks, bonds, and other investments. In this section, we’ll cover the fundamental concepts that you need to know to get started.

What Is Investing?

Investing is the act of allocating resources, usually money, with the expectation of generating income or profit.

This can be done by purchasing assets such as stocks, bonds, real estate, or other financial instruments.

The goal of investing is to increase your wealth over time, either through capital appreciation (the increase in value of an asset over time) or by generating income (such as dividends or interest payments).

Investment Goals

Before you start investing, it’s important to establish your investment goals.

What do you want to achieve with your investments? Are you looking to generate income, grow your wealth, or both?

Your investment goals will help you determine the types of investments that are right for you.

Remember, the higher the reward you expect, the riskier your strategy will be.

Risk vs. Reward

All investments carry some degree of risk. The key is to find the right balance between risk and reward.

Generally, investments that offer higher potential returns also come with higher risk.

Conversely, investments that offer lower risk also tend to have lower potential returns. It’s important to understand your risk tolerance and to choose investments that align with your goals and risk tolerance.

Overall, understanding the basics of investing is crucial for beginners.

By establishing your investment goals and understanding the risks and rewards of different investments, you can make informed decisions that will help you achieve your financial goals.

Below I provide some investing examples with associated risks.

Investing Examples

In order to prove to you that investing works and can generate consistent returns pretty much risk-free, I’ll show you to examples of investing in the stock market.

Example #1 – Consistent Low-Risk Returns

If you have a decent budget to invest, this option is likely for you.

You can invest your money into an index like Dow Jones. Meaning that you’re investing in 30 largest value companies in the US.

You don’t have to choose a single stock to invest in or monitor the most valuable companies at the time.

If the company loses its value, Dow Jones kicks it out of its list and adds a new one.

As a result, even if one company loses everything and its stock price drops to 0 (which is very unlikely!), you’ll lose only 1/30 of your investment.

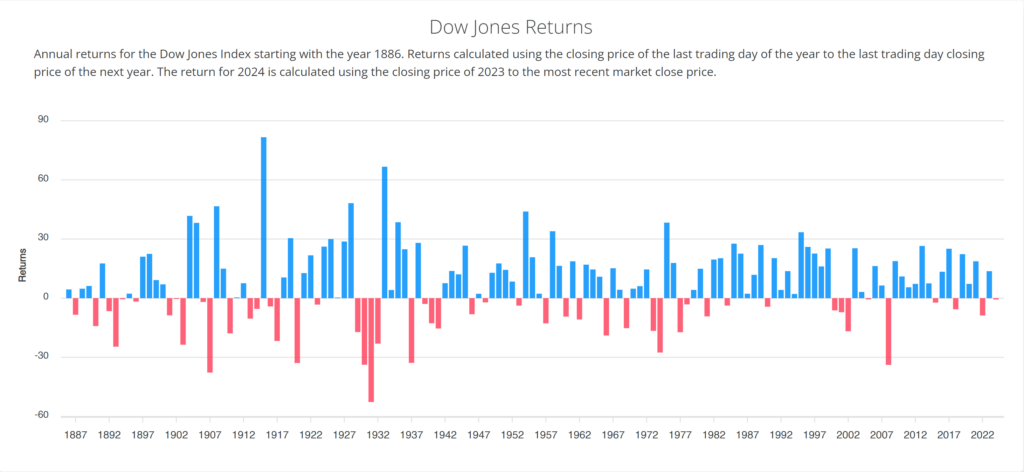

Such a low-risk option carries lower yearly returns. If we look at historical data, these are yearly returns you would get if you invest in DJIA from 1st January till 31st December.

The average yearly returns of the Dow Jones Index in the last:

- 5 years – 11.33%

- 10 years – 12.39%

- 20 years – 9.75%

- 30 years – 9.90%

These are the average yearly returns you would get on your investment if you invested in DJIA 5, 10, 20 or 30 years ago.

As you can see from the graph, there are years when recessions happen and stock prices drop significantly. However, the average yearly returns were calculated considering you do nothing during recessions, so stock prices eventually jump up again.

There are ways to avoid such years and increase your average yearly returns further, but I won’t dive into them in this article.

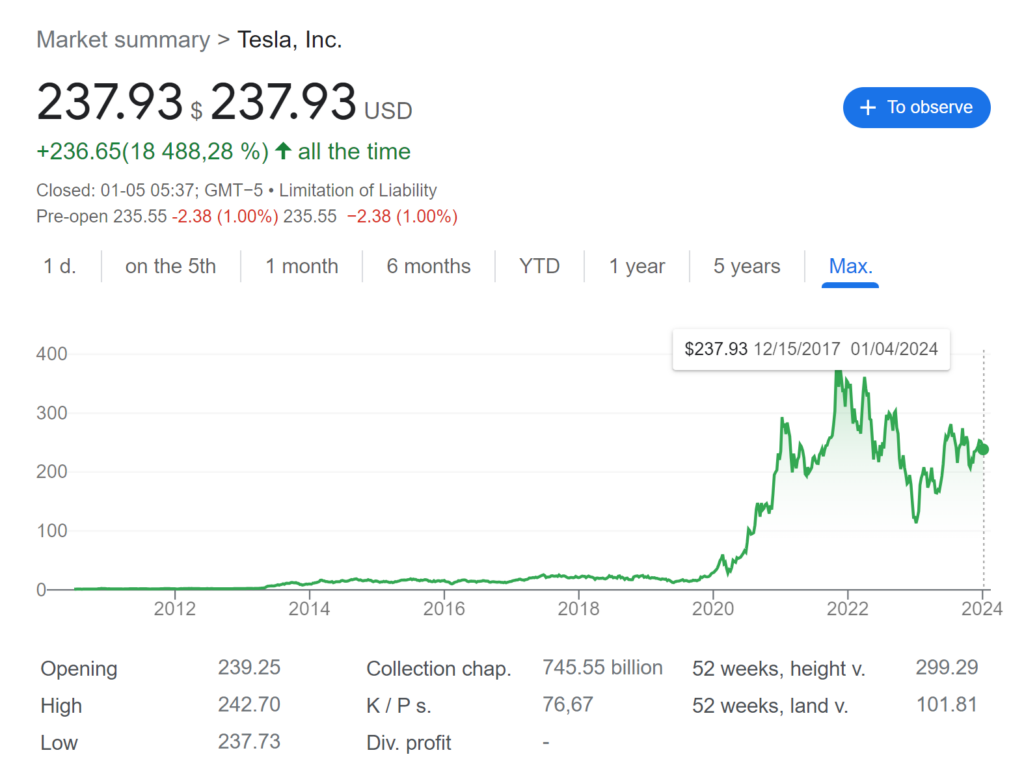

Example #2 – High-Risk Investment

If you don’t have a huge budget to invest, you can pick single stocks that have a chance to jump in price by 1000%.

As an example, Tesla’s stock rose by over 18,000% from 2010.

If you’re lucky to pick such stocks, you will make a fortune quickly; however, you have more chances to lose your investment.

I don’t recommend this option unless you really know what you’re doing.

Setting Up for Success

As a beginner investor, it’s important to set yourself up for success by establishing a strong financial foundation. This includes creating a budget, building up an emergency fund, and managing any outstanding debt.

Creating a Budget

One of the first steps to investing is to create a budget. This involves tracking your income and expenses to determine how much money you have left over each month.

By doing so, you can identify areas where you may be overspending and make adjustments to free up more money for investing.

There are many tools available to help you create a budget, such as online budgeting apps or spreadsheets.

It’s important to be realistic when setting your budget and to make sure you’re accounting for all of your expenses, including bills, groceries, and entertainment.

Remember, investing is not a sprint; it’s a marathon.

If you don’t have a huge budget to invest upfront, you can keep adding little by little every month.

Emergency Fund Importance

Another important aspect of setting yourself up for success is building up an emergency fund. This is a separate savings account that is used to cover unexpected expenses, such as car repairs or medical bills.

Having an emergency fund can help you avoid dipping into your investment accounts in the event of an unexpected expense. It’s recommended to have at least three to six months’ worth of living expenses saved up in your emergency fund.

Debt Management

Finally, it’s important to manage any outstanding debt you may have before investing.

High-interest debt, such as credit card debt, can eat away at your investment returns and make it difficult to achieve your financial goals.

Consider creating a debt repayment plan that prioritizes paying off high-interest debt first. This can help you save money on interest charges and free up more money for investing in the long run.

I don’t recommend relying on returns of investment to pay off high-interest debts.

You’ll feel stressed and likely end up with a larger dept.

By creating a budget, building up an emergency fund, and managing your debt, you can set yourself up for success as a beginner investor. These steps will help you establish a strong financial foundation and make it easier to achieve your long-term financial goals.

Investment Options

As a beginner investor, it is important to understand the various investment options available to you. Here are some popular options to consider:

Stocks

Stocks, or equities, represent ownership in a company.

When you buy a stock, you become a shareholder in that company. The value of your investment can increase or decrease depending on the performance of the company and the market as a whole.

It is important to research the company and its financials before investing in their stock.

These days, I mainly invest in stocks. If you invest wisely, stock investing is a low-risk and decent-return option.

Bonds

Bonds are a type of debt security that represent a loan made by an investor to a borrower, typically a corporation or government entity.

The borrower pays interest to the investor over a set period of time, and at the end of the term, the principal is repaid.

Bonds are generally considered to be less risky than stocks, but also offer a lower potential return.

If you want to really minimize the risks, consider bonds.

Mutual Funds

Mutual funds are a type of investment that pools money from multiple investors to purchase a portfolio of stocks, bonds, or other securities.

This diversification can help reduce risk and provide exposure to a range of assets.

Mutual funds are managed by professional fund managers who make investment decisions on behalf of the investors.

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds in that they offer exposure to a diversified portfolio of securities. However, ETFs are traded on an exchange like a stock, and their prices fluctuate throughout the day.

ETFs can offer lower fees and greater flexibility than mutual funds.

In summary, there are a variety of investment options available to beginners, including stocks, bonds, mutual funds, and ETFs.

It is important to do your research and understand the risks and potential returns of each option before investing.

Investing Strategy I Use

In example #1 I provided above, you learned that investment in the Dow Jones index can generate an average of 10% per year, even if you do nothing during recession years when stock prices can drop by 30-50%.

To increase yearly returns to 15-20% I make, you have to beat the market.

To achieve such returns, you have to predict years of recessions and sell your stocks before the recession starts.

From my experience, no one is able to predict the timing of recessions accurately; however, there are multiple indicators that predict upcoming recessions within 1-2 years.

I won’t dive into those indicators in this article as it will take another 2000 words to explain them.

Another option to beat the market and maximize returns is by choosing the months you want to be fully invested.

So instead of investing from 1st January till 31st December, you can spot a better pattern and invest, let’s say, from March till September.

Or instead of buying a whole Dow Jones index of 30 companies, you can buy single stocks from the Dow Jones list, for example, 5 or 10 companies.

Final Word

Investing can be really easy, straightforward and predictable unless you decide to overcomplicate it by yourself and make a 1000% return in a month.

When starting out, I recommend focusing on low-risk investing options like bonds or value stocks.

Let your money make those 3-10% returns, even if the rewards don’t change your life at all.

However, you’ll obtain valuable skills and be able to explore advanced strategies for higher yearly returns.